The 2017 furniture bonus can be obtained by replacing the boiler, an intervention similar to extraordinary maintenance, in the event that the old boiler is replaced With a new one, guaranteeing energy savings, And enjoying its tax deduction of the 50%. Let's see how.

Furniture Bonus 2017: what is it?

The 2017 Furniture Bonus is a tax deduction of 50% of the expenses incurred for the purchase of furniture and / or large appliances of high energy class, A +, or A in the case of ovens, intended for furnishing a building subject to building renovation . It is not the first time that a measure of this type has been adopted, but it is an extension of those already applied in previous years, with very similar rules and procedures.

The facility included in the recent budget law is Intended for those who buy furniture and / or home appliances in the 2017 and has carried out, or is carrying out, construction renovation work begun since January 1st 2016.

If, on the other hand, the purchase of the furniture or household appliance took place in the period between 6 June 2013 and 31 December 2016, you can take advantage of the deduction if you have incurred expenses for the restoration of the building assets starting from 26 June 2012 .

The Irpef deduction is to be shared among those entitled (eg in the case of interventions on common parts of residential buildings), will be calculated on a maximum amount of 10.000 Euros and divided into 10 annual rates. The roof of expenditure refers to each housing unit.

Types of interventions that entitle you to the 2017 Furniture Bonus for the purchase of furniture and appliances

Not all types of work give the opportunity to use the Mobile Bonus, below is a list of interventions that the Revenue Agency indicates as compatible.

- Ordinary maintenance, carried out on the common parts of a residential building.

- Extraordinary maintenance performed on the common parts of residential buildings and on individual residential real estate units.

- Conservation restoration and restoration, carried out on the common parts of residential buildings and on single residential units.

- Renovation of building, carried out on the common parts of a residential building and on single residential units.

- Interventions necessary for the reconstruction or restoration of the damaged property due to calamitous events, even if they do not fall within the categories listed in the preceding paragraphs, provided that the state of emergency is declared.

- Restoration and conservation restoration and restoration works, relating to whole buildings, carried out by construction or renovation companies and building cooperatives, which provide within 18 months from the end of the work to the subsequent assignment or assignment of the building.

The Revenue Agency Guide vs. January 2017 in the FAQ clarifies that they can not benefit from the Mobile Bonus those who have an energy upgrade of the building for which the 65% deduction is expected.

While in the case of replacing a boiler, it is possible to take advantage of the aid because the intervention falls among the "extraordinary maintenance" but it is still necessary that there is an energy saving compared to the pre-existing situation and that it will benefit from the respective deduction of the 50%.

How to get the incentive

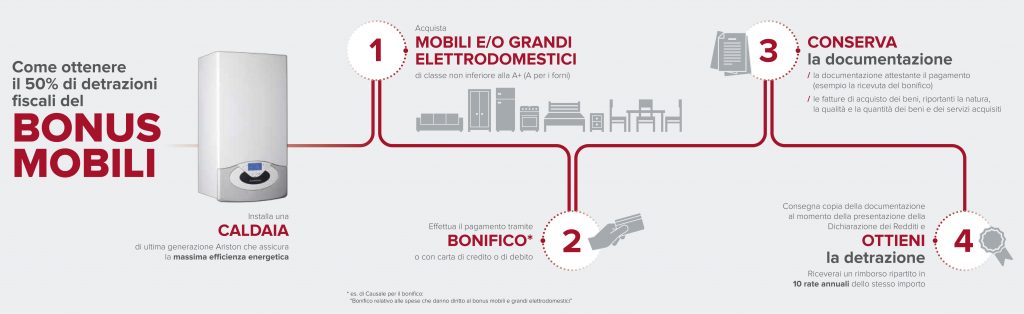

Once the compatibility between boiler replacement and Bonus Mobili 2017 has been clarified, let's see, step by step, how to obtain the incentive.

- The first step is to replace the boiler, an operation that to be considered an extraordinary maintenance of the building must allow energy savings compared to the previous one. This constraint can be respected by choosing one condensing boiler, Is the most evolved type of gas boiler and thanks to increased energy efficiency it can also reach a saving of 40%.

- In order to qualify for the Bonus Mobili, it is also necessary to take advantage of the reduction of the replacement of the boiler for energy saving (deduction of the 50%) made.

- We can therefore proceed with the purchase of furniture and appliances. For furniture some examples of types allowed are: Beds, cupboards, drawers, bookcases, desks, tables, chairs, bedside tables, sofas, armchairs, chests, mattresses, lighting fixtures, while for large appliances: Refrigerators, freezers, washing machines, dryers, dishwashers, electric stoves, microwave ovens, electric heating plates, electric heating appliances, electric radiators, electric fans, air conditioning units.

In the case of the purchase of household appliances, these must have an energy class of not less than A +, or of A only for ovens.

wanting take advantage of the 2017 Furniture Bonus for the purchase of an air conditioner, In our opinion one of the most interesting scenarios, could draw on the whole Range of Ariston air conditioners in class A +, or contact the Kios Ariston inverter air conditioning of which we have already spoken, able to reach the energy class A +++

Among the expenses to be deducted may include those of transport and assembly of the goods purchased.

- Another condition that must be absolutely respected is that Payment of purchased furniture and appliances must be made by bank transfer or credit card.

- Keep the documentation that attests your payment Like: rReceipt of the transfer, receipt of the transaction (for credit card or debit card payments), billing documents on the current account, purchase invoices of goods, indicating the nature, quality and quantity of goods and services acquired.

- The deduction for the purchase of furniture and household appliances is obtained by indicating the expenses incurred in the income statement (730 model or Personal Income Taxes). You will have to Deliver a copy of the documentation at the time of submission of the Income Statement To get the deduction split into 10 annual rates of the same amount.

Summary of steps

We invite you to also read our insights on New EU rules on energy efficiency standards, Some considerations on How to choose the boiler and the article about the new inverter air conditioner High energy efficiency kiosk, offering the possibility of total remote control of the climate.